This signifies that the more you save, the upper dividends you shall earn. The Pag-IBIG monthly membership savings is pegged at simply Php100. Employed members instantly double their monthly financial savings with the counterpart share of their employees. This implies that the more one has saved, the higher dividends that member shall earn.

This time spherical it might quite simply be times the scale relying on how much time I have on my palms. I guess it's very uncommon for a RS to allow you to put away a 4-figure sum every month. Most are within the £50-£250/month region, with some exceptions who permit you to contribute extra each month at a greater price, however solely in return for also taking out a current account. Whether you've obtained a selected financial savings goal in mind - from a new automobile, good holiday, the home of your dreams or on your retirement, it may be tough to work out the place to put your cash to maximise your savings. Evaluating high-deductible protection with an HSA could be tough, with lots of variables. Consulting with a knowledgeable financial advisormay be helpful when sorting by way of these variables.

Tax Center

Exactly one 12 months after you opened your Regular Saver Account interest might be added to the steadiness and the maturity course of will start. This exhibits you what the speed could be if curiosity have been paid and compounded every year.Grossis the speed of curiosity if curiosity had been paid and not compounded every year. We've increased our Regular Saver rate for model spanking new and existing customers from 1st December 2022. The Credit Union will make the $1 deposit in the Regular Savings account required to open a membership for you.

Because our content is not financial recommendation, we advise speaking with an expert before you make any determination. A no access saving savings account can maintain your cash locked away and offer you guaranteed savings development. You’re typically obliged to keep cash locked in for a set period of time and might not be capable of withdraw with no penalty.

Way2save® Savings

In this column we unpack two supplemental health financial savings options value considering — the Health Savings Account and Flexible Spending Arrangement . Unlimited withdrawals are also permitted without penalty and interest is calculated daily and awarded to the steadiness on the primary business day of the month. If you're employed, top up or add to your monthly membership savings via your employer by submitting the “Request for Upgrading of Savings” kind.

Some banks limit withdrawals to six per thirty days after the Federal Reserve set that limit only to withdraw it in April 2020. Exceed six withdrawals, and a bank would possibly impose a payment, close your account, or convert it to a checking account. The quantity that might be withdrawn is limited only to how much is in the account. With the exception of promotions promising a exhausting and fast rate until a certain date, banks and credit score unions may change their charges at any time. Typically, the more competitive the rate, the extra probably it is to fluctuate.

Checking Accounts

Savings accounts generally have restrictions on the number of transactions you can even make per 30 days. Alternatives to financial savings accounts include checking accounts, cash market accounts and certificates of deposit. 1The dividend rate and annual proportion yield might change at any time.

Finally, you can use tax-free withdrawals to pay for retirement health prices, similar to Medicare Part B and Part D premiums, and Medicare Advantage premiums. While this account offering has remained aggressive for a quantity of consecutive months, as Mr Mountford commented, this isn’t the very best price in the marketplace for regular savers. “It should also be noted that regular saver products assist folks to take a more disciplined approach to financial savings plus they allow savers to begin out with relatively small month-to-month contributions."

Checking

She has a journalism degree from the University of Sheffield and has been a journalist for more than 10 years, writing on subjects including fintech, fee systems and retail. In her spare time, Michelle likes to travel, explore new foodie experiences and attempt to improve her own culinary expertise. Some folks opt for this obligation to economize each month, as it’s a great way to construct up financial savings at an inexpensive pace. Chase Bank serves nearly half of U.S. households with a broad vary of merchandise. For questions or issues, please contact Chase customer support or let us know at Chase complaints and feedback.

NatWest / RBS have not communicated to existing DRS account holders that the maturity-amount (is that the best word?) had elevated from £1k to £5k. Bruce Helmer and Peg Webb, financial advisers at Wealth Enhancement Group and co-hosts of “Your Money” on KLKS one hundred.1 FM on Sunday mornings. First Direct has simply doubled the speed on its Regular Saver account from three.50% to 7%, the highest fee it’s been for practically a decade. If you'll have the ability to commit to placing even a small quantity away every month, you can earn returns as excessive as 7%. Topping the list is first direct’s Regular Saver Account offering an rate of interest of seven percent AER. The NatWest Digital Regular Saver is offering customers a aggressive 5.12 percent Annual Equivalent Rate .

Current Customers

For a greater experience, download the Chase app in your iPhone or Android. Gross is the rate of interest if curiosity have been paid and never compounded every year. Projection supplied for illustrative purposes solely and doesn't take into account particular person circumstances. You’ll be succesful of see your money through our Mobile App and Online Banking as soon as the account has closed and the processing work is complete. Your cash will be mechanically transferred to a Savings Account. If you don’t have a sole Savings Account, your Regular Saver will convert into a brand new sole Savings Account.

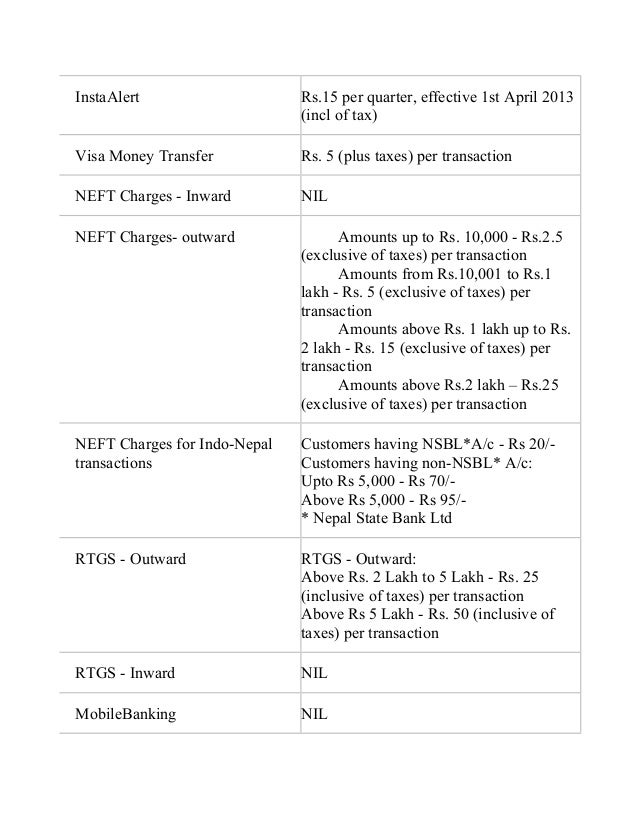

No, you can only have one Regular Saver at any one time even if you’re not saving the utmost allowance of £300 per month. 1st Account customers can apply by downloading and logging on to our App and going to ‘Products’ or through Online Banking. Click here to see the detailed remittances/fund transfers charges. Bank of America Private Bank is a division of Bank of America, N.A., Member FDIC and a completely owned subsidiary of Bank of America Corporation.

Changes within the federal funds rate can trigger institutions to adjust their deposit charges. Some institutions offer high-yield savings accounts, which may be price investigating. Most high-yield savings accounts offer variable interest rates. Meaning, the rate of curiosity you earn can go up or down relying on factors similar to the general financial system. The amount you keep in your financial savings account will depend in your objectives for the funds, or your use of the account.

No comments:

Post a Comment